About us

Icknield operates from its London office and provides both advisory and hands-on practical help to businesses needing to improve their performance through profit/cash improvement plans or through creating and implementing a turnaround strategy. The Icknield team have extensive experience in helping management teams improve their businesses and deal with funding or other challenges.

Icknield’s history

Icknield was formed by Steve Smith in 1995 based in Royston in Hertfordshire.

Initially projects were UK based but subsequently extended to continental Europe with larger clients frequently having worldwide operations.

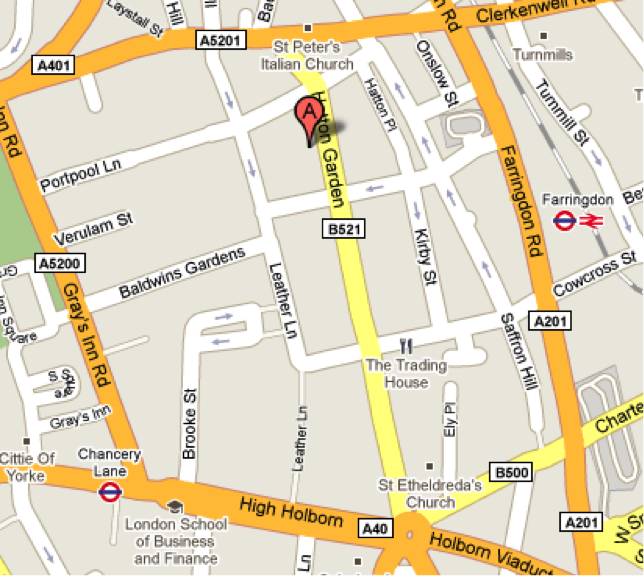

In 2010 Icknield opened an office in Hatton Garden, London.

The source of the Icknield name

The name “Icknield” originates from the Icknield Way, a prehistoric pathway stretching from Ivinghoe Beacon in Buckinghamshire to Knettishall Heath in Norfolk and passing through Royston, where the company began. It is one of the oldest roads in Britain, and was considered ancient even when the Romans began using it.

The way we work

Our Services

Our role will be designed to match your needs and be aligned with delivering results.For the duration of the project we will become part of the team with responsibility to create the plan and deliver the results.

· Turnaround services

· Profit improvement

· Interim management

· Cash management

· Working capital improvement

· Restructuring

Performance improvement projects

We can work on an advisory or hands-on basis depending on the client’s circumstances.

In all cases we will agree an appropriate team which will involve one or more of the Icknield team plus the relevant managers from the client. If the project requires specialist skills (e.g. supply chain) Icknield will introduce experts from its network.

Turnaround projects

Our services are often the difference between the survival and the failure of an organisation, so it is essential for us to work inside the client organisation alongside existing company personnel. Consequently, for the duration of projects, members of the Icknield team usually assume relevant executive responsibilities.

Engagements are with the client organisation, and our duty of care is to our clients, but we work closely with all stakeholders and their advisors to develop solutions that will deliver a better future for the client.

Who we work with

Public companies

We have worked with a variety of UK AIM listed and fully listed companies. In Europe we have helped Swiss listed groups with working capital and restructuring.

We are familiar with the rules that listed companies need to comply with but always work closely with the plc’s advisers to make sure that requirements are met.

Owner managed private businesses

Past projects include owner managed companies in various sectors and unincorporated businesses.

The owners of these types of businesses can be assured that Icknield has experience of addressing the sensitive matters which can arise.

Private equity owned companies

The Icknield team has been involved with under-performing private equity backed companies in both the UK and in continental Europe. We have provided interim managers, working capital improvement programmes, cash managers as well as restructuring support.

Throughout a project the Icknield team is closely involved with the client’s funders to make sure that the solutions work for all parties. Icknield has worked within a variety of financing situations including.

- Single banked

- Multi-banked bi-lateral

- Syndicate of banks

- Bondholders

- Asset based lending

- Distressed debt lenders

- Finance leasing

Why choose Icknield?

• Extensive experience of working with troubled companies with over 160 projects in a wide variety of companies

• Successful track record

• Team approach providing back up and support where needed

• Flexibility in role – both in the position taken and extent of involvement – part time roles are frequently undertaken

• Hands on approach – getting into the detail

• We deliver a rapid improvement in visibility of cash, trading and financial performance and drive initiatives in parallel to deliver improved performance

• Speed of response – we can usually meet a company within 48 hours of receiving a call and often within 24 hours

Sector experience

Icknield has worked across a broad range of sectors and can usually bring sector experience to new projects.

Oil industry

Electronics

Underwater cables

Amusement machines

Automotive products

Ink products

Textiles

Shoe components

Furniture

Cruise operator

Law firms

Engineering consultants

Care homes

Home shopping

Furniture

Cash & carry

Turnaround services

Turnaround Teams

Icknield can provide the Turnaround Team which deals with the whole of the turnaround cycle comprising:

• Crisis stabilisation

• Turnaround plan creation

• Restructuring

• Turnaround implementation

If a specialist skill needs to be brought in to address a particular area e.g. supply chain then Icknield can deliver the solution through its network of contacts.

Turnaround Plans

When a turnaround plan is needed Icknield works with the management team to develop a deliverable turnaround plan, agree the plan with stakeholders and help implement the changes needed for the plan to succeed.

The key areas we would typically be involved with are:

• Creating visibility of the true under lying operational and financial performance

• Identifying the drivers of under performance

• Managing the production of realistic “as is” and post turnaround projections

• Producing an action plan to address each element of under performance

• Obtaining stakeholder support

Example – Paramount Restaurants Case Study

Profit improvement

Companies which are profitable and cash positive can still be under performing their potential and have substantial room for profit improvement.

Icknield has worked in a number of situations where substantial profit improvement is possible. Our approach to each situation varies but the standard steps usually involved comprise:

• Undertaking a short review to produce a high level assessment of the extent of profit improvement which is feasible

• Comparing performance against key competitors

• Reviewing the key drivers of profit in each segment of the business focussing on:-

– Revenue – how can it be increased?

– Gross margin – what steps can be taken to improve margins?

– Overheads – what costs can be eliminated without affecting revenue?

• Creating an action plan and timeline for each activity required to improve profitability

• Bringing the various initiatives into an overall Profit Improvement Plan

Interim management

When companies hit problems, management teams are stretched and often turn to advisors for help. This will result in advice which is helpful but doesn’t provide the extra resource that is really needed.

Without extra experienced resource a stretched management team will have little option but to focus on fire fighting. The result is that management do not have sufficient time to deal with their normal job of running the business and if this continues then the business can quickly deteriorate.

Challenging circumstances can also result in gaps in the management team and these gaps can be difficult to full quickly.

Icknield can cover the extra roles required and if necessary assume senior interim roles at short notice.

The Icknield team has undertaken a variety of interim roles:

• Chairman

• Chief Restructuring Officer

• Chief Executive

• Chief Operating Officer

• Finance Director

Cash management

Icknield has extensive experience of hands on specialised cash management and working capital improvement.

In a distressed corporate environment, the window of opportunity to find an optimum solution for all stakeholders is increased by hands-on management, forecasting and monitoring of cash combined with working capital improvement. In addition, any new funding required can usually be reduced through active cash management.

Our services are tailored to ensure a complete improved solution. All aspects of cash flow management services can be provided including:

• Implementing cash forecasting systems and procedures

• Hands on management of cash flow crises

• Identifying the potential and delivering improvements in cash flow including working capital reduction

• Negotiating proposals with customers, suppliers, lenders (banks, ABL & bond holders) and other creditors including landlords, HMRC and pension trustees

• Creating cash flow plans to ensure survival during stabilisation and restructuring phases of turnaround projects

Projects are usually undertaken on a team basis including existing company personnel so that at the end of the assignment the company has a trained resource as well as effective cash management systems.

Icknield works closely with stakeholders and their advisers to give them clarity on cash and confidence that focussed efforts are being made to control and improve cash flow performance

Working capital improvement

Working capital is key to all businesses but working capital is not always well managed. There are many reasons it is important to have effective systems and processes to manage working capital including:

• Tight liquidity – having more cash than necessary tied up in working capital is dangerous but can be an opportunity to improve liquidity if action is taken

• Reduction in equity value – where assets are tied up in high working capital debt is usually high to fund that position resulting in an equivalent reduction in the external view of equity value

• Profit risk – having too much inventory runs the risk of obsolescence and high receivables usually means a substantial overdue element which is where bad debts can arise

Icknield’s working capital improvement services cover all aspects including:

• Receivables reduction can often be about proactive management together with changes in processes and procedures as well as trading terms. We have taken over direct management of credit control functions on some projects in order to deliver receivables reduction.

• Inventory reduction often requires detailed analysis of a large number of line items in order to generate an effective place to release cash tied up in stock. Our team is experienced in undertaking this analysis.

• Where appropriate we can support projects to extend payment terms with suppliers

• We don’t just look at receivables, inventory and supplier credit, we look at everything that could result in a permanent cash flow improvement when we undertake working capital improvement projects. This involves the processes in the business e.g. how quickly a customer receives an accurate invoice.

We work closely with the management team so that they own the project and will therefore make the improvement permanent.

Restructuring

Icknield has years of experience of the practical aspects of corporate restructuring. When a company hits troubled times it needs good professional advice and needs to be able to act on that advice. Frequently a company in these circumstances will not have sufficient experienced resource available internally. Icknield can solve this problem by managing the stabilisation and restructuring phases on the company’s behalf.

• A full service from crisis management to restructuring and turnaround

• Stabilisation

• Avoiding a cash crisis (or bringing a crisis under control)

• Providing visibility on key drivers to the board, shareholders and lenders

• Obtaining shareholder/lender support

• Cost reduction and corporate surgery

• Restructuring

• Proposing a new financial structure

• Negotiating solutions with lenders and shareholders

• Helping management with practical issues e.g. business continuity planning & implementation where restructuring involves a change in business ownership and/or an insolvency process

• Turnaround

• Creating and implementing a turnaround plan

• Driving the changes ourselves or bringing in appropriate resource to deliver this

• Changing the board/management team where necessary to deliver the solution

• Assuming a CRO role during the above phases

• Continuing role during the continued turnaround post restructuring

Projects

Icknield has undertaken over 150 projects in a broad variety of sectors. The projects include turnaround, restructuring, cash management, interim management and working capital improvement.

All of Icknield’s projects are company side working alongside management or becoming part of the executive team.

Recent Project – Rio Laranja Empreendimentos Turisticos Lda – Portugal

| Year | 2011 – 2013 on-going |

| Company | Rio Laranja Empreendimentos Turisticos Lda – Portugal |

| Sector | Leisure |

| Activity | Fractional ownership resort |

| Ownership | Bank owned following debt/equity swap |

| Icknield role | Current roles as director of the company and chairman of the holding company Previous roles of cash management, interim FD and restructuring |

| Key achievements | Turnaround plan prepared and agreed with stakeholders Cross border debt/equity swap implemented Specialist operator appointed |

| Contact for further info | shahin@icknield.com |

Case studies

Bar & restaurant group

| Year | 2007-08 |

| Company | The Food & Drink Group plc |

| Sector | Leisure – bars & restaurants |

| Ownership | AIM listed |

| Icknield role | Joining the board as finance director and replacing the finance team.Leading processes to create options and find a solution. |

| Status at start of project | Trading under performance with some locations loss making, cash flow negative, over leveraged and with the finance director having left at short notice. |

| Options explored | Share placing – support from some institutional shareholders but insufficient new investor interest to enable equity to be raisedDisposal of entire group or divisions – no solvent solution was found |

| Icknield team | Steve Smith and Dorothy Szulc |

| Outcome | Profitable parts of the group were sold through a pre-pack administration preserving all the jobs in those locations. |

| Year | 2009 |

| Company | Regent Inns plc and iNTERTAIN Ltd |

| Sector | Leisure – bars, restaurants and comedy venues |

| Ownership | Plc was delisted. Through the restructuring ownership moved to bank lenders and the management team. |

| Icknield role | Assisting development and implementation of the operational and financial restructuring. |

| Status at start of project | The group was loss making and cash negative. The group also had substantial contingent liabilities under leases of bars which had been sold. |

| Icknield team | Steve Smith, Shahin Gulamali, Jaco van Niekerk and Dorothy Szulc |

| Key achievements | All loss making sites and all contingent liabilities under assigned leases removed from the on-going businessRapid solution to reduce pre restructuring lossesCreating a cash positive group immediately after restructuring |

Rio Laranja Empreendimentos Turisticos Lda (“RLET”) is a Portuguese based company, established in 1987 to build and operate a resort in the Algarve. Click here for Portuguese resort case study

| Year | 2013 |

| Company | Confidential |

| Sector | Property |

| Activity | Accommodation business |

| Ownership | Private |

| Icknield role | Cash management, interim FD, establishing management reporting and refinancing support |

| Key achievements | Cash managed to avoid new funding need pending refinancing.Monthly financial reporting established. Refinancing completed |

| Contact | steve@icknield.com |

The Business

The Paramount Restaurants business (“Paramount”) was head quartered in London and comprised a UK group of 38 owned and operated restaurants under the owned brand names of Chez Gerard, Brasserie Gerard, Caffe Uno and Bertorelli.

When Icknield became involved, the businesses were producing a top line of £40m but an EBITDA loss after central costs.

Paramount was owned by a syndicates of banks who were also the secured lenders following a financial restructuring. Previously the group had been owned by a private equity firm who had taken the listed company Paramount Restaurants plc private.

There had been a number of changes in management at Paramount over the past few years. The most recent strategy had been to sell some of the restaurants to fund the group’s cash requirements and create sufficient liquidity to reinvigorate the brands through investment. Disposals had been achieved, but the cash raised had now been absorbed by trading and one off costs.

Key Icknield achievements

- Steered the board, management and lenders through the options for the business

- Introduced an Operations Director who drove trading improvement

- Achieved a 50% head office cost reduction within 2 months

- Completed a financial restructuring to reduce debt and create a viable platform for the business as well as supporting the signing of statutory accounts

- Brought in resources to manage cash and avoid the forecast need for additional funding

- Worked with advisers to identify purchasers to dispose of the majority of the restaurants to other restaurant operators

- Provided the banks with an exit

The Team

Steve Smith was appointed Executive Chairman at the end of July 2011 after five months as a non-executive director.

Shahin Gulamali assisted in the creation of restructuring proposals.

Icknield also provided cash management services prior to disposals occurring.

Icknield introduced an Operations Director to the business with a brief to halt the declining revenue and EBITDA.

The Turnaround

Following Steve Smith’s appointment as executive chairman, Paramount adopted a dual strategy of turning around the business to make it financially viable whilst seeking buyers who could support the investment needed in the restaurants.

The turnaround of the operating business comprised:

- Stabilisation of the previously declining revenue line

- Tight control of operating costs

- 50% reduction in central costs in August/September 2011

- Financial restructuring in September 2011 to reduce debt and create a stable financial platform

The central costs reduction was designed to bring the total costs of the business to a level which restaurant profits could sustain.

Separate buyers were identified for the Chez Gerard and Brasserie Gerard restaurants which comprised the majority of the trading units. One of the buyers pulled out at a late stage of legal implementation. A number of separate transactions were then identified to replace that buyer.

By September 2011 trading trend lines had started to improve and central costs were substantially reduced. The high street marketplace was highly competitive for the Brasserie Gerard chain and the need to reinvest in the restaurant premises remained. Consequently the decision was made to sell the business.

The Chez Gerard restaurants and brand were sold to Brasserie Blanc through a pre-pack transaction with the remaining sites being sold in a number of separate deals. Brasserie Blanc immediately commenced a major upgrade programme for the Chez Gerard sites.

Contact steve@icknield.com for further information.

Texon International Group Ltd

| Year | 2004 – 2013 on-going |

| Company | Texon International Group Ltd |

| Sector | Manufacturing |

| Activity | Manufacture and distribution of shoe components |

| Ownership | Bank |

| Icknield role | Appointed in 2004 as interim FD and CRO becoming a NED post restructuring |

| Key achievements | Restructuring implemented in 2005 via an organised receivership to deal with legacy liabilities and create a corporate structure which has enabled a business turnaround French businesses brought back out of an insolvency process New funding need contained via intensive cash management programme Worked with chairman to deliver new management teams over extended period Active non exec role to support/guide management post restructuring |

| Awards | International Turnaround award in 2012 by the Institute for Turnaround |

| Contact for further info | steve@icknield.com |

Confidential professional services company

| Year | 2012 – 2013 |

| Company | Confidential |

| Sector | Professional services |

| Ownership | Partnership |

| Icknield role | Preparing a profit and capital improvement programme and assisting the management team renegotiate terms with lenders |

| Icknield team | Steve Smith |

| Contact for further info | steve@icknield.com |

Vantis plc

| Year | 2009-2010 |

| Company | Vantis plc |

| Sector | Professional services |

| Activity | Accountancy and tax services |

| Ownership | AIM listed |

| Icknield role | Interim FD.CRO, cash management, cost reduction |

| Key achievements | Loss making/cash making business held together Substantial creditor pressure managed over an extended period All operational jobs saved |

| Contact | steve@icknield.com |

Services and equipment supplier to oil and gas producers

| Year | 2011-2012 |

| Company | Confidential |

| Sector | Oil & Gas – Cick here for Icknield case study |

| Activity | Services and equipment supplier to oil and gas producers |

| Ownership | Private equity |

| Icknield role | Working capital improvement |

| Key achievements | Identified the potential for working capital to be reduced by 10% of turnover Assisted management in implementation with 50% of potential achieved within 3 months |

| Contact for further info | steve@icknield.com |

High street jewellery chain

| Year | 2010-2011 |

| Company | Confidential |

| Sector | Retail |

| Activity | High street jewellery chain |

| Ownership | Private |

| Icknield role | Cash management leading to restructuring planning/implementation |

| Contact for further info | steve@icknield.com |

IT equipment rental company

| Year | 2010-2011 |

| Company | Confidential |

| Sector | |

| Activity | IT equipment rental |

| Ownership | Private |

| Icknield role | Cash management |

| Key achievements | Eliminated additional funding requirement and supported solvent change of ownership/funding |

| Contact for further info | steve@icknield.com |

Hotel owner and operator

| Year | 2010-2011 |

| Company | Confidential |

| Sector | Hotels |

| Activity | Ownership and operation of luxury hotels |

| Ownership | Private |

| Icknield role | Cash and supplier management during extended going concern disposal programme |

| Contact for further info | steve@icknield.com |

Ennstone plc

Ennstone plc was a UK listed aggregates group with operations in the UK, Poland and the USA. Steve Smith was appointed CRO and joined the board in November 2008. The group was under severe pressure due to a structural negative cash flow. A restructuring was completed in March 2009 and Steve Smith remained on the board whilst costs were reduced and working capital further improved leading to the UK business reversing into an AIM listed company.

Vantis plc

Vantis plc was an AIM listed accountancy group which Icknield worked with in 2009/2010.

Full case study being posted soon

| Year | 2001 |

| Company | Vio Worldwide |

| Activity | Online services for the advertising industry with offices in UK, France, Japan, US and Australia |

| Ownership | Jointly owned by a UK FTSE 100 company and an overseas partner |

| Icknield role | CRO – Icknield was appointed to implement an orderly and solvent wind down |

| Status at start of project | The business was loss making requiring USD1m funding every month from its shareholders. One of the partners could not sustain the required funding and there was no plan to support additional investment |

| Key achievements | Losses reduced to low levels whilst maintaining customer services Going concern sale achieved Project achieved faster and at a lower cost than the agreed budget |

| Contact for further info | steve@icknield.com |

The Team

Icknield Team

The Icknield Team has grown steadily since it started in 1995 and now comprises 8 executives. All of the team are qualified accountants and have worked in listed or private companies in executive roles prior to joining the Icknield Team.

A senior team member will work on, lead or support all projects with typical roles including CRO, interim FD and advisory positions.

All team members have cash management experience and also undertake interim management and turnaround executive positions.

The Icknield team frequently undertake projects where a team approach is needed and 2 or more of the team are involved as required.

The Icknield Network

The Icknield Network comprises experienced turnaround/interim managers who join the teams working on turnaround projects when their expertise is required. The Icknield Network includes operational, supply chain, IT and M&A managers in addition to interim finance executives.

Steve Smith

Steve works with both listed and private UK companies and international groups assuming board, advisory or executive roles during stabilisation and restructuring phases of turnaround projects. Steve also works with underperforming groups to deliver profit, cash flow and working capital improvement.

Prior to founding Icknield in 1995 Steve had a number of financial roles in UK listed companies including 6 years as group treasurer of The Rank Organisation plc. Steve is a chartered management accountant, fellow of the Association of Corporate Treasurers, member of the Institute for Turnaround and a member of R3.

Roles include CRO at Ennstone plc, CRO at Vantis plc, chairman at Chez Gerard Restaurants Ltd and advising a professional services partnership.

Ran Oren

Ran has worked with Icknield for 6 years.

Ran works with AIM listed and family owned businesses as CRO or interim FD taking board positions when needed and focussing on turnaround, restructuring and cash management roles.

Prior to working with Icknield Ran had spent several years as an independent executive mainly in interim FD roles in the UK and The Netherlands. Ran trained and qualified as a chartered accountant with Deloitte & Touche in Israel. Ran is a member of the Institute for Turnaround.

Shahin Gulamali

Shahin joined Icknield 8 years ago.

Shahin works with listed and privately owned companies on turnaround, profit improvement and cash management roles taking interim FD and board positions in the UK and more recently in Europe.

Prior to working with Icknield Shahin was an independent executive and previously worked in PWC’s Business Regeneration Services team. Shahin is a chartered accountant and a member of the Institute for Turnaround.

Recent roles include assisting a professional services practice, creating a turnaround plan for a European leisure resort and restructuring of a UK jewellery retail chain.

David Lightowler

David has been involved in the corporate turnaround sector for over 20 years, initially working at Coopers & Lybrand. He has extensive experience in many sectors with considerable expertise in managing cash crisis positions for organisations with a turnover between £20-£100m.David is highly skilled in communicating with the creditor base, building and regaining their confidence whilst managing the competing demands for cash within the business. He is a Chartered Accountant (ACA) with a BA in Accountancy.

David Lightowler’s roles have included an 18 month project with a loss making, over indebted financial services business.

Mark Russell

Mark Russell, ACA, spent 14 years in the profession at Arthur Andersen and KPMG. He has 9 years of experience as an independent executive working with SME’s.

Mark started working on Icknield projects in 2014.

Mike Simpson

As a turnaround specialist for Icknield Mike focuses on distressed businesses with cash flow issues. With over 23 years financial management experience Mike has previously owned a profitable business for 15 years, held the positions of MD and FD in SME’s and worked with international groups on interim projects.

Mike is a qualified accountant (FCCA) with over 23 years PQE.

Mike’s roles include a project advising an international business in the oil & energy sector on working capital management and business planning for an accommodation business.

Dorothy Szulc

Dorothy has spent the last 10 years working with Icknield and has experience across a wide range of sectors including manufacturing, telecoms, publishing and leisure in both private and listed companies.With 20 years financial management experience Dorothy specialises in turnaround projects focusing on cash management, financial control, modelling and management accounting. Dorothy is a qualified accountant (ACMA).

Dorothy’s roles have included cash management at an accommodation business and completing complex real estate transactions for a shared owernship holiday resort.

Victoria Tresigne

Victoria has rejoined the Icknield team after devoting her time to raise a family.Victoria qualified with KPMG before undertaking public and private FD roles. Victoria is a chartered accountant and specialises in cash management, interim FD roles and project management.

See this page in a different language using Google Translate: